Why This Matters to You Right Now

If you’ve been thinking about installing a geothermal system in Indiana, time is running out. The generous federal tax credits that have made these systems affordable for thousands of Hoosier families are about to disappear thanks to recent legislative changes. Here’s everything you need to know to make the most of what’s left.

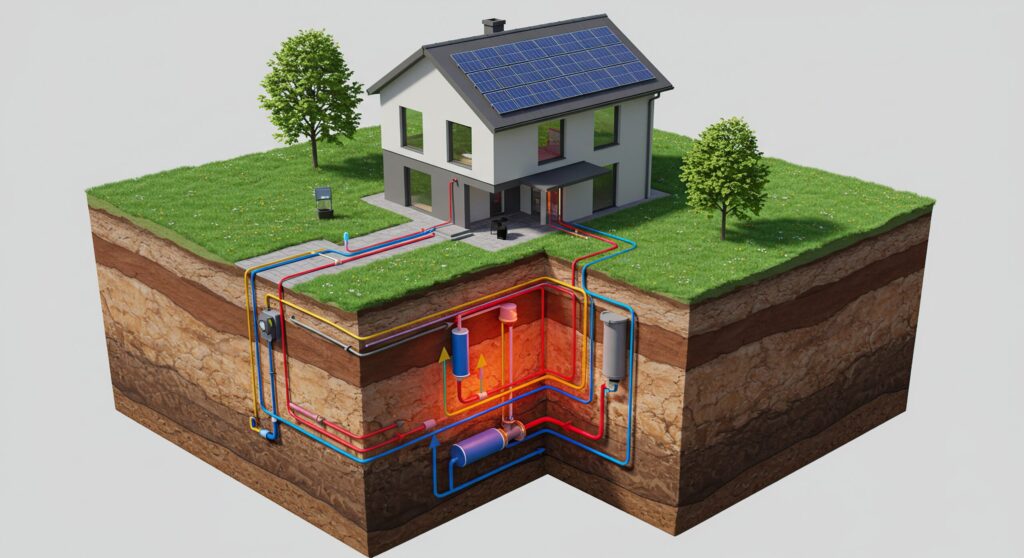

Geothermal systems are pretty amazing when you think about it – they tap into the Earth’s consistent underground temperature to heat and cool your home incredibly efficiently. Indiana homeowners who’ve made the switch often see their energy bills drop by up to 70%. But the upfront cost? That’s where tax credits have been a game-changer.

Unfortunately, the One Big Beautiful Bill Act (OBBBA) passed in July 2025 is pulling the rug out from under most clean energy incentives, including geothermal credits, starting January 1, 2026. So if you’re on the fence, this is your last chance to take advantage of substantial savings.

In this comprehensive guide, we’ll cover everything Indiana residents and businesses need to know:

- What the geothermal tax credit is and how it benefits you

- Federal residential tax credit details and the 2025 deadline

- Federal commercial and utility-scale tax credits for businesses

- Why the Geothermal Tax Credit is expiring

- Indiana-specific incentives and what’s still available

- Step-by-step instructions for claiming your credits

- Eligibility requirements and practical considerations for Hoosiers

- Resources and tools to help you make the best decision

What Exactly Are We Talking About?

When people mention “the geothermal tax credit,” they’re usually referring to federal tax incentives that help offset the cost of installing qualified geothermal systems. For homeowners, this means the Residential Clean Energy Credit. For businesses, it’s the Investment Tax Credit (ITC).

The systems that qualify fall into two main categories:

Geothermal Heat Pumps (GHPs): These are the ground-source systems most Indiana families install. They handle your heating, cooling, and hot water needs, but they must have ENERGY STAR certification to qualify for credits.

Geothermal Power Generation: These are the big utility-scale systems that generate electricity from underground heat – not something most of us install in our backyards, but important for Indiana’s energy future.

Beyond the immediate tax savings, these systems offer long-term benefits like dramatically lower energy bills, reduced carbon emissions, and increased home value. The Inflation Reduction Act of 2022 had expanded federal credits to a generous 30% through 2032, which aligned perfectly with Indiana’s push toward renewable energy. But OBBBA changed all that.

The Federal Residential Credit: What’s Still Possible for Indiana Homeowners

Right now, Indiana homeowners can still claim 30% of their qualified geothermal heat pump costs through the Residential Clean Energy Credit. This covers everything – the system itself, installation labor, piping, wiring, the works. And unlike some tax credits, there’s no dollar cap on how much you can claim.

Here’s the catch: You need to complete your installation by December 31, 2025, to get this credit. After that? It’s gone entirely, per OBBBA.

The credit is nonrefundable, meaning it can reduce your tax liability to zero but won’t generate a refund beyond that. However, if you can’t use the full credit in one year, you can carry it forward to future tax years.

To qualify, the system must be for your primary or secondary residence here in Indiana. It has to be new equipment, and you’ll need to subtract any rebates or subsidies you receive from the total cost before calculating your credit.

One bright spot: if you’re a lower-income Indiana household, you might qualify for additional rebates up to $8,000 through the IRA’s Home Efficiency Rebates programs, which launched in May 2025 through the Indiana Energy Saver Program.

Business and Commercial Opportunities

For Indiana businesses, the landscape is a bit more complex but still offers opportunities – at least through 2025.

For commercial geothermal heat pumps, there’s a base Investment Tax Credit of 6% that can jump to 30% if you meet certain requirements like paying prevailing wages, using apprentices, buying domestic equipment, or installing in designated energy communities.

For geothermal power generation, the credits are actually sticking around longer than most other renewables. Unlike solar and wind credits that OBBBA is eliminating, geothermal power projects can still access substantial incentives for projects that begin construction by 2033.

USDA’s Rural Energy for America Program also offers grants and loans for rural Indiana businesses looking to go geothermal.

Indiana-Specific Incentives: What’s Changed

Indiana’s incentive landscape has been a bit of a roller coaster lately. The state used to offer a property tax deduction for geothermal systems, but that was retroactively repealed from January 1, 2025. However, if you already own a property with an existing geothermal system, you can keep that deduction until January 1, 2027, for taxes assessed before 2025.

What’s still available:

Indiana Energy Saver Program: Offers rebates for energy-efficient upgrades, including heat pumps, for both single-family and multifamily homes ().

Utility Rebates: Some Indiana utilities like Vectren and Citizens Gas offer rebates for ENERGY STAR geothermal heat pumps. Check the Database of State Incentives for Renewables & Efficiency (DSIRE) for current offerings.

Weatherization Assistance Program: Low-income Hoosiers can get help with energy conservation measures, potentially including geothermal systems.

How to Actually Claim Your Credits

For the federal residential credit, you’ll file IRS Form 5695 with your 2025 tax return. Make sure you keep everything – invoices, manufacturer certifications, ENERGY STAR labels, installation receipts. The IRS wants to see proof that your system qualifies.

The key thing to remember is that the credit is based on when your system is installed and operational, not when you file your taxes. So a system installed in December 2025 would be claimed on your 2025 tax return, filed by April 15, 2026.

For Indiana-specific incentives, contact your county auditor for property tax questions or apply through the Indiana Energy Saver Program for available rebates.

Is Geothermal Right for Your Indiana Home?

The good news: Geothermal systems typically last 25+ years and work exceptionally well in Indiana’s climate. Many homeowners see significant energy savings year after year.

The challenges: The upfront cost can range from $10,000 to $30,000 for residential systems, and not every property is suitable. You need adequate yard space for the ground loop system, and soil conditions matter.

The time crunch: With OBBBA eliminating federal credits after 2025, we might see supply chain issues as everyone rushes to install systems before the deadline.

If you’re considering geothermal for your Indiana home – whether you’re in Greenwood, Franklin, Fishers, Carmel, or anywhere else in Central Indiana – use tools like ClimateMaster’s Geothermal Savings Calculator to estimate your potential savings. The Department of Energy’s Expert Match program can also connect you with technical assistance.

The Bottom Line for Hoosiers

If you’ve been thinking about geothermal, 2025 is your year to act.

➡️ Contact us now to schedule a consultation. 📞 (765) 534-4328

The 30% federal tax credit represents thousands of dollars in savings that simply won’t be available in 2026. Combined with Indiana’s generally supportive stance on renewable energy (despite recent setbacks), the timing makes sense for many families.

Talk to one of our qualified installers, run the numbers for your specific situation, and remember that tax laws can be complex. Consider consulting with a tax professional to make sure you maximize all available incentives.

The clock is ticking, but there’s still time to join the thousands of Indiana families who’ve already discovered the benefits of geothermal energy – just don’t wait too long.

Where to Learn More

- IRS Residential Clean Energy Credit information

- ENERGY STAR Geothermal Heat Pumps Tax Credit details

- DOE Tax Credits for Geothermal Heat Pumps

- DSIRE Database for state-specific incentives

- Indiana Energy Saver Program

- Indiana’s Geothermal Program information

Always consult with tax professionals for personalized advice, as laws and regulations continue to evolve.